Reduce the America National Debt

There is no easy solution to the America national debt. Depending on the measures taken to reduce it, there will be consequences that could have an impact on our future, including the possibility of a financial crisis or even an uncontrolled default. The good news is that there are ways to reduce the debt and return to fiscally responsible policies without hurting our citizens. The first step is to educate the American people about the dangers of the debt and what it will take to reduce it. When the people understand what is at risk, they can reward politicians who are fiscally responsible with their votes.

The America national debt has grown to a level that is far beyond what most economists believe to be sustainable. It is estimated that the federal government will spend more than it takes in every year from now on. Unless something changes, by 2020 the debt will be well above 90% of GDP (on a cyclically adjusted basis). The CBO projects that the Obama administration’s budget proposals would cause the debt to increase to a projected 90% of GDP by the end of the decade.

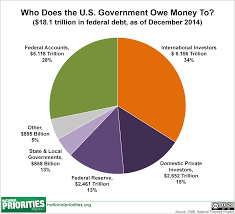

Governments typically borrow money to avoid raising taxes and to stimulate the economy through public spending. When a nation borrows money it must pay interest to its creditors, which takes away from the amount of tax income that can be used for other purposes. While borrowing money to avoid raising taxes may give a short-term boost to economic growth, the long-term effects of issuing debt are negative.

What Measures Can Be Take to Reduce the America National Debt?

One of the most important measures to reduce debt is to cut government spending. However, cutting military spending and social programs is often unpopular with voters. Consequently, many politicians have shied away from taking the necessary steps to reduce the debt.

Another measure to reduce the debt is to raise taxes. While this is not a popular option with the American people, raising taxes can be effective in reducing the debt. This is because increased taxes can help to reduce the deficit by lowering the rate at which the government can pay its debts.

A third way to reduce the debt is to lower interest rates. Historically, nations with high debt levels have lowered interest rates in order to encourage investment and create jobs. Moreover, lower interest rates make it easier for individuals and businesses to borrow, which helps to increase tax revenue. This has been the strategy of many nations, including the United States, when facing sizable and growing debts.

While it is difficult to find a specific number to target when it comes to the debt-to-GDP ratio, there are some general guidelines that should be followed. Ideally, the debt-to-GDP ratio should be below 70%, which would allow the nation to operate without having to rely on international capital markets. This is important because a sudden reduction in the willingness of foreigners to lend to the United States could lead to a sharp slowdown in economic growth and an increase in U.S. interest rates.